First-Time Buyers May Have it Easiest Here

First-time home buyers are entering the market under tight inventory conditions and rising home prices. But not all cities are posing a challenge for those looking to break in to homeownership.

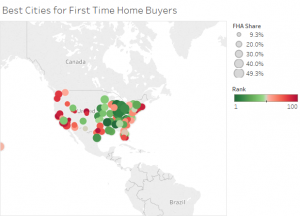

A new study by LendingTree ranks the top cities for first-time home buyers in the nation’s 100 largest cities. They factored in average down payment amounts, the share of buyers using an FHA mortgage, the share of homes sold that the median income family can afford; and more.

First-time home buyers in Little Rock, Ark.; Birmingham, Ala.; and Grand Rapids, Mich., topped LendingTree’s list as best cities for first-time home buyers in 2018. Both Little Rock and Birmingham have low average down payments of just 12 percent or $24,896 and $27,000, respectively. Grand Rapids proved to be the best place to be an FHA borrower (59 percent).

On the other hand, LendingTree found in its analysis that Denver, New York, and San Francisco ranked as the most challenging cities for first-time buyers.

These 10 cities ranked at the top for first-time home buyers:

1. Little Rock, Ark.

2. Birmingham, Ala.

3. Grand Rapids, Mich.

4. Youngstown, Ohio

5. Winston, N.C.

6. Dayton, Ohio

7. Indianapolis

8. Scranton, Pa.

9. Pittsburgh

10. Cincinnati

View the full top 100 rankings and a breakdown of each data point analyzed for each city at LendingTree.

Source: LendingTree

Daily Real Estate News | Friday, February 16, 2018