Thinking about buying? Selling your home? Call Perrella and Associates. Range wide service!

WORKING WEDNESDAY

5 Home Accents Interior Designers Loathe

Interior designers are trained to know what works and doesn’t work in a home. Some designers recently advised against purchasing certain home furnishings, whether you are staging a home or moving into one. Avoid these interior design eyesores for the sake of a home’s style:

Overstuffed chairs.

“I get that lounge chairs are comfortable, but they’re truly the elephant in the room,” Karen Gray-Plaisted, a home staging and decor pro with Design Solutions KGP, told realtor.com®. Huge recliners can cram a space.

Outdated drapes.

“Long, heavy drapes or inner coverings made of lace are done,” says Gray-Plaisted. Instead, she suggests opting for lighter, more modern designs. “Side panel curtains with beautiful hardware hung above the window allows in light and highlights the architectural detail of the windows.”

Matched sets.

A matching sofa, chair, and ottoman can make a room appear dull, designers say. “It’s like walking into a sea of wood, which could have looked better with a mix of texture and color if the pieces had been chosen separately,” says Carole Marcotte, an interior designer with Form & Function in Raleigh, N.C. She recommends homeowners buy a few pieces from one furniture set and then mingle in other styles for more contrast. For example, Bee Heinemann, an interior designer with Vant Wall Panels, suggests removing the love seat and replacing it with two chairs from a different collection.

Cheap furniture.

Inexpensive pieces that are poorly made or constructed—using materials such as particle board—will chip, fade, and fall apart. These end up costing homeowners more money in the long run. “Buying furniture you plan to replace every few years isn’t smart,” says Sara Chiarilli, owner of the design firm Artful Conceptions in Tampa, Fla. Instead, designers suggest purchasing high-quality, neutral pieces. Then, add pops of color with pillows or other accents.

Small rugs.

“Clients often underestimate rug size and there’s nothing worse than having furniture surround a dinky one,” says Marcotte. “The pieces don’t need to sit completely on the rug—just aim for the front third or half of the chairs and couch to straddle it.”

Source: “7 Things Interior Designers Really Wish You Wouldn’t Buy (You’ve Got at Least One),” realtor.com® (Dec. 29, 2017)

Daily Real Estate News | Tuesday, January 02, 2018

HAPPY FRIDAY EVERYONE!!!

Owners Rush to Prepay Property Taxes Before Losing Benefits

With tax reform signed into law, homeowners in areas with high property taxes are scrambling to prepay their 2018 tax bill in order to take advantage of deductions that will be severely curtailed once the legislation takes effect Jan. 1. The new tax law, which Congress passed and President Donald Trump signed last week, caps the amount of state, local, and property taxes that homeowners can deduct at $10,000.

Some counties already allow for prepayment of taxes, while others are rushing to provide residents the ability to do so after strong demand. For example, local officials in Montgomery County, Md., say they’re fielding requests to prepay taxes for the first time ever, which prompted them to hold a special meeting the day after Christmas to come up with a plan.

“It just never came up [before],” George Leventhal, a Montgomery County councilman, told CNNMoney. “No one was saying, ‘Please let me make early payment of a bill I don’t owe yet.’ Wise cash management suggests you should pay closer to the due date, not farther away. But because of this change, it seems it could be possible that people could derive some benefit and deduct their property taxes for next year in 2017.”

Nearly half of the county’s taxpayers have more than $10,000 in combined state and local taxes, Leventhal says.

Still, there’s no guarantee homeowners who prepay their 2018 property taxes will be able to deduct the payment. On Wednesday, the IRS posted to its website an advisory notice that said prepaying property taxes will work only under limited circumstances. To qualify for the deduction, property taxes will need to be paid in 2017—but they also must be assessed in 2017. That means homeowners who prepaid their taxes based on estimated assessments or who tried to pay several years’ worth of taxes at once will likely still face the new limited deductions, The New York Times reports.

Source: “Homeowners Scramble to Pre-Pay Property Taxes,” CNNMoney (Dec. 27, 2017) and “Prepaying Your Property Tax? IRS Cautions It Might Not Pay Off,” The New York Times (Dec. 27, 2017)

Daily Real Estate News | Thursday, December 28, 2017

HAPPY NEW YEAR EVERYONE, LET’S ALL HOPE FOR A GREAT 2018!!!

Hibbing House Fire

Please keep the Gillitzer family in our hearts and prayers.

WARM THOUGHTS WEDNESDAY

Protect a Home’s Pipes From the Cold

Cold weather can put your home’s pipes at risk of exploding. Worst case scenario: Pipes can fill up with so much ice that eventually they burst and then flood a home.

But there’s plenty you can do to keep your pipes safe in the winter, as a homeowner or landlord. Precautions should be ideally taken in the fall, but if you forgot, better to take steps now than none at all.

HouseLogic offers the following tips for protecting your pipes from bursting, including:

Turn on your faucets.

When temperatures have dropped into freezing, turn on your faucets both indoors and out to keep the water moving through your system. HouseLogic recommends aiming for about five drips per minute.

Open cabinet doors.

Open any cabinet door covering the plumbing in the kitchen and bathroom. The home’s warm air can help prevent pipes from freezing.

Wrap the pipes.

If the pipes are already near freezing, wrap them in warm towels to help loosen the ice inside. Cover them with towels and then pour boiling water on top.

Shut off the water.

If your pipes are already frozen, turn off the main water line to the home immediately. Shut off any external water sources, such as garden hose hookups, HouseLogic recommends. This also helps after the ice inside your pipes thaws because you don’t want the water to flood your system.

Read more tips at HouseLogic.

Source: “5 Tricks to Keep Your Pipes From Exploding This Winter,” HouseLogic (December 2017)

Daily Real Estate News | Wednesday, December 27, 2017

Merry Christmas and a Happy New Year

From all of us a Perrella & Associates

THURSDAY THOUGHTS

What Buyers Will Give Up for Walkability

Living in areas that are close to shops and restaurants is becoming increasingly attractive for both young and older generations, according to the 2017 National Community and Transportation Preference Survey conducted by American Strategies and Meyers Research on behalf of the National Association of REALTORS®. Researchers polled 3,000 adults from across the United States to find out what they are looking for in a community.

Fifty-three percent of Americans say they prefer to live in a community with homes that have smaller yards but are within easy walking distance of the community’s amenities (rather than homes with large yards where residents have to drive to amenities) according to the survey.

Certain generations show even more fondness for living near amenities. Sixty-two percent of millennials and 55 percent of the silent generation (those born before 1944) say they prefer walkable communities and short commutes, even if it means living in an apartment or townhouse. Meanwhile, Generation X members and baby boomers show a strong preference for the suburbs; 55 percent of them told researchers they have no problem with a longer commute and driving to amenities as long as they can live in a single-family, detached house.

“REALTORS® understand that when people buy a home, they are not just looking at the house; they are looking at the neighborhood and the community,” says NAR President Elizabeth Mendenhall. “While the idea of the ‘perfect neighborhood’ is different for every homeowner, more Americans are expressing a desire to live in communities with access to public transit, shorter commutes, and greater walkability. REALTORS® work tirelessly at improving their communities through smart growth initiatives that help transform public spaces into these walkable community centers.”

Learn how members are transforming town centers with creative reuse, smart growth initiatives, and project funds from NAR.

Women tend to prioritize walkability and public transit more than men, according to the survey. Fifty-four percent of women surveyed said that sidewalks and places to take walks are very important to them when deciding where to live. Thirty-nine percent also said having public transit nearby was important.

Overall, 60 percent of the 3,000 adults surveyed live in a detached, single-family homes. But of those 60 percent, 21 percent said they would rather live in an attached home that offered greater walkability. Sixty percent of those surveyed also said they’d be willing to pay more to live within walking distance of parks, restaurants, and shops. Further, 80 percent of respondents said that sidewalks are a positive factor when purchasing a home.

Source: National Association of REALTORS®

Daily Real Estate News | Wednesday, December 20, 2017

Choir Concert

Choir Concert tonight at 6:15 p.m. at the Lincoln School in Hibbing.

Salvation Army

The Hibbing Salvation Army will host a Christmas dinner (feeding program) Friday December 22 from 4 p.m. to 5 p.m.

MONDAY NEWS

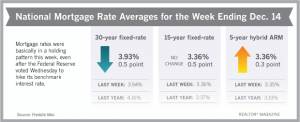

Despite Fed Move, Mortgage Rates Hold Steady

Mortgage rates were in a holding pattern this week, even after the Federal Reserve voted Wednesday to hike its benchmark interest rate.

“As widely expected, the Fed increased the federal funds target rate this week for the third time in 2017,” says Len Kiefer, Freddie Mac’s deputy chief economist. “The market had already priced in the rate hike, so long-term interest rates—including mortgage rates—hardly moved. Mortgage rates held relatively flat across the board, with the 30-year fixed mortgage rate inching down 1 basis point to 3.93 percent in this week’s survey. Mortgage rates have been in a holding pattern for the fourth quarter, remaining within a 10 basis point range since October.”

Freddie Mac reports the following national averages with mortgage rates for the week ending Dec. 14:

30-year fixed-rate mortgages: averaged 3.93 percent, with an average 0.5 point, dropping from last week’s 3.94 percent average. Last year at this time, 30-year rates averaged 4.16 percent.

15-year fixed-rate mortgages: averaged 3.36 percent, with an average 0.5 point, the same as last week. A year ago, 15-year rates averaged 3.37 percent.

5-year hybrid adjustable rate mortgages: averaged 3.36 percent, with an average 0.3 point, rising from last week’s 3.35 percent average. A year ago, 5-year ARMs averaged 3.19 percent.

Source: Freddie Mac

Daily Real Estate News | Friday, December 15, 2017