New Listing! 3402 2nd Ave West, Hibbing — $33,500

Perfect fixer upper on a nice corner lot! Efficient use of space / 3 bedrooms / 1 bathroom / Sauna / Cellar / Natural gas heating / A number of new windows / Hardwood floors under carpet throughout the house! Affordably priced! Would make a great rental property. Appliances and furniture available. Great opportunity!

Virtual Tour – http://www.tourfactory.com/idxr1941128

THANKFUL FRIDAY’S

Spring May Not Be Pretty for First-Time Buyers

A shortage of homes and surging prices are hitting first-time buyers particularly hard heading into the spring season. The share of first-time homeowners dropped to 29 percent of all existing-home sales in January, down from 33 percent a year ago, according to the latest housing report from the National Association of REALTORS®.

Read more: 2018 Home Sales Off to a Sluggish Start

“First-time buyers are typically people with a tighter budget,” says Joseph Kirchner, realtor.com®’s senior economist. “They’re looking for homes on the more affordable end of the market, but that is where the lack of homes is most severe. … There’s plenty of demand, but people just cannot find a home on the market that meets their needs and they can afford. It’s not a good start for the spring market. The shortage will continue.”

In January, there were 15.5 percent fewer existing homes selling for $250,000 or less compared to a year ago. On the other hand, the biggest gains in homes were from those selling for $500,000 or more, which saw a 25 percent uptick.

Existing-home prices were up in every major region of the U.S. The West had the most expensive homes at a median of $362,600 in January, an 8.8 percent increase from over a year ago. The Northeast’s median prices reached $269,100 in January, up 6.8 percent annually. The South’s median home price of $208,200 is up 4.3 percent from a year ago, while the Midwest’s $188,000 median price is up by 8.7 percent.

“It’s very clear that too many markets right now are becoming less affordable and desperately need more new listings to calm the speedy price growth,” Lawrence Yun, NAR’s chief economist, said in a statement.

Source: “Lack of Homes on the Market Tames a Toll on First-Time Buyers,” realtor.com® (Feb. 21, 2018) and “Homeownership Is Increasingly for the Wealthy, According to the Latest Sales Data,” CNBC (Feb. 21, 2018)

Daily Real Estate News | Thursday, February 22, 2018

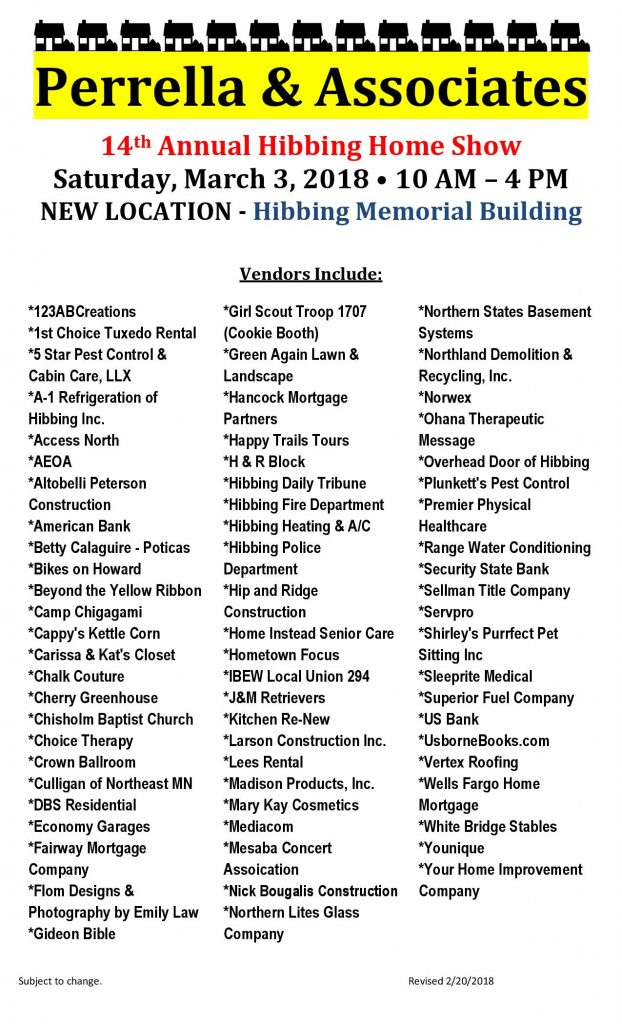

Home Show – Super Hero photos!

Come to the Perrella Home Show on Saturday March 3rd at the Hibbing Memorial Building and get your Super Hero photo! Flom Designs and Photography will be set up from 10:00am-4:00pm. Photos will be available for download online.

WORKING WEDNESDAY

Higher Rates Offset Loan Demand

Home buyers and homeowners may be getting spooked by higher mortgage rates. Mortgage applications for both home purchases and refinancings plummeted 6.6 percent last week on a seasonally adjusted basis compared to the previous week, the Mortgage Bankers Association reported Wednesday.

Volume is now just 3.5 percent higher than a year ago, with annual increases continuing to shrink week to week.

Applications to refinance dropped 7 percent last week but are still 2.8 percent higher than a year ago. Applications to purchase a home dropped 6 percent last week and are 3 percent higher than a year ago.

Affordability is weakening as home prices continue to rise. Mortgage rates also are now more than half a percentage point higher than at the start of the year.

“The drumbeat continues,” says Mike Fratantoni, the MBA’s chief economist. “Inflation is increasing, as are deficits, and the economy and job market continue to look strong, and rates are higher as a result. This upward move in rates is coming right at the start of the spring buying season and is a headwind.”

The 30-year fixed-rate mortgage averaged 4.64 percent last week, the highest level since January 2014, the MBA reports.

More borrowers are turning to adjustable-rate mortgages, which tend to have lower initial rates than the 30-year fixed-rate mortgage. However, the lower rates from an ARM can be risky since the rates are locked in for a shorter term. ARM applications rose to 6.4 percent of total applications last week.

Source: “Weekly Mortgage Applications Tank Even More, as Rising Rates Make Homes Less Affordable,” CNBC (Feb. 21, 2018)

Daily Real Estate News | Wednesday, February 21, 2018

HAPPY MONDAY

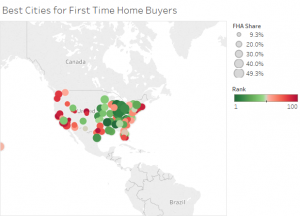

First-Time Buyers May Have it Easiest Here

First-time home buyers are entering the market under tight inventory conditions and rising home prices. But not all cities are posing a challenge for those looking to break in to homeownership.

A new study by LendingTree ranks the top cities for first-time home buyers in the nation’s 100 largest cities. They factored in average down payment amounts, the share of buyers using an FHA mortgage, the share of homes sold that the median income family can afford; and more.

First-time home buyers in Little Rock, Ark.; Birmingham, Ala.; and Grand Rapids, Mich., topped LendingTree’s list as best cities for first-time home buyers in 2018. Both Little Rock and Birmingham have low average down payments of just 12 percent or $24,896 and $27,000, respectively. Grand Rapids proved to be the best place to be an FHA borrower (59 percent).

On the other hand, LendingTree found in its analysis that Denver, New York, and San Francisco ranked as the most challenging cities for first-time buyers.

These 10 cities ranked at the top for first-time home buyers:

1. Little Rock, Ark.

2. Birmingham, Ala.

3. Grand Rapids, Mich.

4. Youngstown, Ohio

5. Winston, N.C.

6. Dayton, Ohio

7. Indianapolis

8. Scranton, Pa.

9. Pittsburgh

10. Cincinnati

View the full top 100 rankings and a breakdown of each data point analyzed for each city at LendingTree.

Source: LendingTree

Daily Real Estate News | Friday, February 16, 2018

2018 Home Show Vendor List

2018 Home Show Entertainment Schedule

HAPPY TUESDAY

Airbnb Income Counts Toward Refinancing

With the backing of Fannie Mae, home-sharing giant Airbnb has announced a new partnership with select lenders, including Quicken Loans, Citizens Bank, and Better Mortgage, that will allow homeowners to report rental earnings as part of their income when applying to refinance a mortgage. Owners who rent rooms on Airbnb had been facing delays, higher interest rates, and loan limitations when refinancing.

“This initiative was developed to identify new ways of recognizing home-sharing income, making it possible for homeowners to maximize their investment to better reach their financial goals,” Airbnb said in a statement. “The project is part of Fannie Mae’s work to find new, innovative ways to expand the availability of affordable mortgage credit.”

If the initial program goes well, Fannie Mae may consider extending it to all of its lenders, according to reports. Airbnb will provide hosts with a proof of income statement that they can use when refinancing an existing mortgage.

Housing studies show mixed results when it comes to the effect of Airbnb on local markets. Some show that a greater number of Airbnb listings in a given location can lead to a slight increase in rents and home prices. Others, however, suggest Airbnb restricts long-term rent growth. Some cities, such as Baltimore and Detroit, are considering new zoning requirements to limit Airbnb rentals in its communities.

Source: Airbnb and “Refinancing a Mortgage? You Can Now Count Airbnb Income,” Curbed.com (Feb. 9, 2018)

Daily Real Estate News | Monday, February 12, 2018

HELLO MONDAY

Utility Bills May Be Getting Cheaper

Utility companies will pay less tax from a recent tax overhaul, and many are planning to pass those savings on to customers. Rate changes may shave a few dollars off the average customer’s bill in the coming months, The Wall Street Journal reports.

The federal government slashed its corporate tax rate from 35 percent to 21 percent. Regulated gas and electric utilities will have to pay less tax, and some state authorities may give regulated utilities little choice but to return that tax savings to its customers, WSJ reports.

Some regulated utilities will be refunding some of the tax payments they collected from customers based on the 35 percent rate. Companies may choose to issue refunds over several years, so the savings may be minimal for customers.

For example, National Grid U.S., a utility holding company with subsidiaries in New York, Massachusetts, and Rhode Island, expects a non-cash tax credit of $2 billion in 2018 from the lower tax rate. “It’s going to be returned to customers over a period of 20 to 30 years,” Peggy Smyth, the company’s finance chief, told The Wall Street Journal.

Some companies are using the tax savings to defray higher costs and prevent having to hike bills. For example, Florida Power & Light said it plans to use its savings to pay for $1.3 billion in recovery costs from Hurricane Irma. Customers may not see any reduction in utility bills, but it will spare them from any increases, the company said.

Duke Energy Corp, with subsidiaries in North Carolina, is in the process of requesting permission from local authorities to cut retail rates or use its tax savings to defray the cost of storm-related recovery efforts, WSJ reports.

“Tax reform has presented us a unique opportunity to reduce customer bills in the near term, while also helping to offset future rate increases,” says Steven Young, Duke Energy’s finance chief.

Source: “As Utilities Move to Pass Tax Savings to Customers, Credit Concerns Arise,” The Wall Street Journal (Feb. 7, 2018)

Daily Real Estate News | Thursday, February 08, 2018