Housing Costs Up 9% for Entry-Level Buyers

The monthly payment for an entry-level home is on the rise. And the rising costs may be one reason why first-time buyers are making up a lower share of buyers this spring. First-time buyers comprised 30 percent of existing-home sales in March, which is down from 32 percent a year ago, according to data from the National Association of REALTORS®.

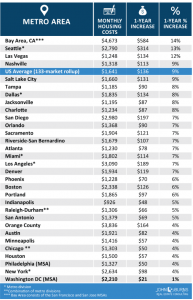

Monthly housing costs for an entry-level buyer increased $136 to $1,641 nationwide, a 9 percent increase from last year, according to data from John Burns Real Estate Consulting. The higher costs means more consumers must be willing to make trade-offs to buy a home, compromising on size, attached versus detached, and location.

More: NAR Chief Economist Lawrence Yun looks at what’s driving inflation.

“First-time buyers continue to make up an underperforming share of the market because there are simply not enough homes for sale in their price range,” NAR President Elizabeth Mendenhall said in a statement. “Supply conditions improve in higher-up price brackets, which means those trading up should see considerable interest in their home, as well as more listings to choose from during their own search.”

The table below from John Burns Real Estate Consulting shows monthly housing costs for an entry-level home in March 2018 as well as the increase over the last year.

Source: “Challenges Mount for First-Time Buyers,” John Burns Real Estate Consulting (April 20, 2018)

Daily Real Estate News | Wednesday, April 25, 2018