Mortgage Costs Grow 20 Times Faster Than Incomes

Share

July 13, 2021

Housing affordability continues to decline as the hot real estate market fuels skyrocketing prices. Incomes aren’t keeping pace with the higher prices.

The median family income rose by 1.2% in May while the monthly mortgage payment jumped by 20%, according to the National Association of REALTORS®’ Housing Affordability Index.

Even as mortgage rates are down compared to a year ago—which has helped buyers save on borrowing costs—the median existing-home price has jumped 24.4% compared to the same period.

Monthly mortgage payments increased to $1,204 in May, a 20% jump compared to a year earlier. NAR’s analysis notes the annual mortgage payment—as a percentage of income—increased to 16.5% over the past year due to higher home prices and a decline in median family incomes.

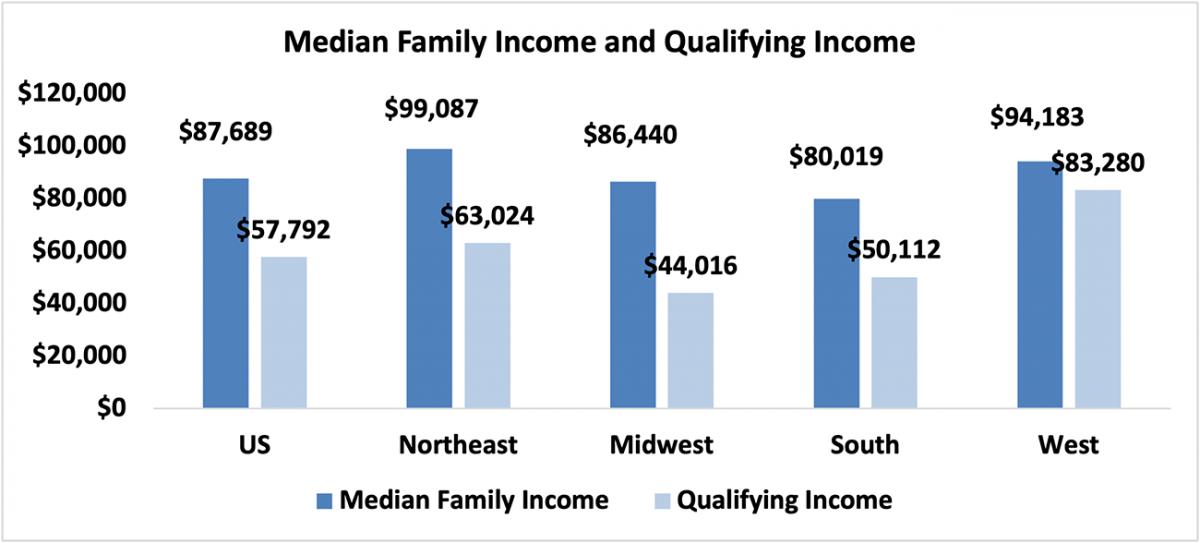

Homeowners in the West have the highest mortgage payments to income share at 22.1% of income. Home prices in the West have climbed to a record high of $513,700.

The most affordable region of the U.S. in housing continues to be the Midwest, in which the median family income is $86,440. NAR’s index calculates a qualifying income as the income required to afford a mortgage so that payments are no more than 25% of a family’s income. The Midwest had a qualifying income of $44,016.

View a further breakdown of the data in NAR’s Housing Affordability Index.Source: “Housing Affordability Falls in May as Home Prices Rise Faster Than Income,” National Association of REALTORS® Economists’ Outlook blog (July 9, 2021)