In a two-year analysis, homes on a mid-Atlantic MLS sold for more money than similar homes that sold off of it. Bright MLS, a multiple listing service that supports more than 95,000 real estate professionals from Pennsylvania to Virginia, conducted the study of 442,829 records for home sales transactions completed between January 2019 and December 2020.

The median sold on the MLS was about 17% higher than homes sold off of the MLS, the study found.

“We have always known the power of the MLS network, and past studies have shown that homes shared cooperatively on the MLS sold for more,” said Brian Donnelley, Bright MLS president and CEO. “We’re proud to be able to confirm with our extensive data that promoting homes through our MLS delivers significant value over other methods.”

Continue…https://magazine.realtor/daily-news/2021/08/03/mls-finds-that-listed-homes-sell-for-17-more

7 Most Affordable Lake Towns

Owning a waterfront property may seem like an unattainable dream to many Americans, but home buyers are still finding affordable areas to buy a house with a view of a lake or easy access to one.

“Lake homes have always been a popular, aspirational home,” Glenn S. Phillips, CEO of Lake Homes Realty, told realtor.com®. “The events of the past year drove additional interest. If you have to socially distance or can work from home, just move to the lake full-time.” Home sales in the 33 lake towns his brokerage services have climbed by 50% over the past year, Phillips added.

Realtor.com®’s research team identified some of the most affordable lake towns in the U.S. by analyzing median list prices from May 2020 through June 2021 in more than 2,000 towns located near a lake. Realtor.com® also factored in towns with the most water-based businesses, such as marinas, waterfront restaurants, and lake activities. For geographic diversity, the site limited the list to one lake town per state.

Continue… https://magazine.realtor/daily-news/2021/07/26/7-most-affordable-lake-towns

LOW INTEREST RATES

Fears Over Delta Variant Drive Mortgage Rates Down

Share

July 23, 2021

Mortgage rates plunged this week as home prices reached new record highs. The 30-year fixed-rate mortgage averaged 2.78%, Freddie Mac reports. “Concerns about the delta variant and the overall trajectory of the pandemic are undoubtedly affecting economic growth,” said Sam Khater, Freddie Mac’s chief economist. “While the economy continues to mend, Treasury yields have decreased—and mortgage rates have followed suit.”

But the low rates aren’t helping many home buyers who either can’t find a suitable property amid historically low inventory or can’t afford the high prices of the ones on the market, Khater said. Still, “these declining rates provide yet another opportunity for homeowners to save money on their monthly mortgage payment through a refinance,” he added.

Freddie Mac reports the following national averages with mortgage rates for the week ending July 22:

- 30-year fixed-rate mortgages: averaged 2.78%, with an average 0.7 point, dropping from last week’s 2.88% average. Last year at this time, 30-year rates averaged 3.01%.

- 15-year fixed-rate mortgages: averaged 2.12%, with an average 0.7 point, dropping from last week’s 2.22% average. A year ago, 15-year rates averaged 2.54%.

- 5-year hybrid adjustable-rate mortgages: averaged 2.49%, with an average 0.4 point, up from last week’s 2.47% average. A year ago, 5-year ARMs averaged 3.09%.

Freddie Mac reports average commitment rates along with average points to better reflect the total upfront costs of a mortgage.Source: “Instant Reaction: Mortgage Rates, July 22, 2021,” National Association of REALTORS® Economists’ Outlook blog (July 22, 2021) and Freddie Mac

Millennials Lead Charge to Revamp Aging Housing Stock

The country’s aging housing stock is prompting homeowners to make more home renovations, particularly among younger owners who have faced limited housing inventories for sale. Nearly half of U.S. homeowners plan to upgrade or remodel their homes this year, according to a new survey from LendingHome, a lender to real estate investors.

But it’s younger homeowners, between the ages of 25 to 44, who are undertaking most renovations and looking to bring new trends and renovations to the aging homes they purchase

Continue… https://magazine.realtor/daily-news/2021/07/21/millennials-lead-charge-to-revamp-aging-housing-stock

How the Race to Space Could Impact Real Estate

Amazon and Blue Origin founder Jeff Bezos flew to suborbital space and back on Tuesday. His journey follows Virgin Records founder Richard Branson’s space trip last week. But what do these billionaire space joyrides have to do with real estate? A lot, if this trend truly takes off, real estate experts say.

The hub locations for aerospace giants such as Elon Musk’s SpaceX and Bezos’ Blue Origin could drive average median real estate prices as they attract job growth and higher incomes.

“If, say, a large tech company decided to open another headquarters with high-income jobs, then the local area will experience a sizable growth in home prices,” NAR’s Chief Economist Lawrence Yun told Fox Business. “Given that SpaceX and Blue Origin employees have sophisticated high-tech skills with presumably high income, the impacted small community real estate market will clearly benefit.”

Continue…https://magazine.realtor/daily-news/2021/07/20/how-the-race-to-space-could-impact-real-estate

FHFA Tosses Extra Refinance Fee!!

FHFA Tosses Extra Refinance Fee for Fannie, Freddie Loans

Share

July 19, 2021

The Federal Housing Finance Agency has announced that Fannie Mae and Freddie Mac will no longer charge an extra refinance fee on loans starting Aug. 1.

The Adverse Market Refinance Fee was added at the end of 2020 to cover losses that were projected to occur from the pandemic. But the FHFA says Fannie and Freddie policies shielded the government-backed mortgage financing firms from severe losses, and the housing market has stayed strong. Therefore, the extra fee is no longer needed, FHFA says.

Lenders will no longer be required to pay Fannie Mae and Freddie Mac a 50-basis-point fee for mortgages they refinance, the cost of which has largely been passed down to borrowers. For example, the fee could have amounted to $1,400 in extra costs on an average $300,000 GSE-backed refinanced loan. Certain loans were exempt from the added fee.

But now that the extra fee is being eliminated, the FHFA says it expects lenders to offer some cost savings to refinancing borrowers. “The COVID-19 pandemic financially exacerbated America’s affordable housing crisis,” FHFA Acting Director Sandra L. Thompson said in a statement. “Eliminating the Adverse Market Refinance Fee will help families take advantage of the low-rate environment to save more money.”

The FHFA had anticipated billions of dollars in loan losses due to expected forbearance defaults once pandemic aid expires. But the majority of borrowers with Fannie Mae- and Freddie Mac-backed loans have already exited COVID-19 forbearance plans, the FHFA says. In April, about 2% of single-family mortgages guaranteed by Fannie Mae and Freddie Mac remained in forbearance, down from a high of about 5% in May 2020.Source: FHFA.gov

More Trade-Up Buyers Use Reverse Mortgages to Finance Move

More home buyers are using reverse mortgages to purchase their next home. A new study finds that a quarter of 170 new home buyers surveyed wouldn’t have purchased a new home without using a reverse mortgage for financing.

“This is incredibly important insight, especially when you consider more and more baby boomers are moving into bigger homes rather than downsizing,” says Rob Cooper, national sales leader at Reverse Mortgage Funding LLC, which conducted the study. “Our study found there is a lot of room for improvement when it comes to recommending reverse mortgage for purchase financing because most people are not even aware of this option—or have not been well informed about it.”

The majority of borrowers who used a reverse mortgage to purchase a new home said they were able to buy a more expensive home or a property in a more desirable location because of it.

Continue… https://magazine.realtor/daily-news/2021/07/15/more-trade-up-buyers-use-reverse-mortgages-to-finance-move

Mortgage Costs Grow 20 Times Faster Than Incomes

Mortgage Costs Grow 20 Times Faster Than Incomes

Share

July 13, 2021

Housing affordability continues to decline as the hot real estate market fuels skyrocketing prices. Incomes aren’t keeping pace with the higher prices.

The median family income rose by 1.2% in May while the monthly mortgage payment jumped by 20%, according to the National Association of REALTORS®’ Housing Affordability Index.

Even as mortgage rates are down compared to a year ago—which has helped buyers save on borrowing costs—the median existing-home price has jumped 24.4% compared to the same period.

Monthly mortgage payments increased to $1,204 in May, a 20% jump compared to a year earlier. NAR’s analysis notes the annual mortgage payment—as a percentage of income—increased to 16.5% over the past year due to higher home prices and a decline in median family incomes.

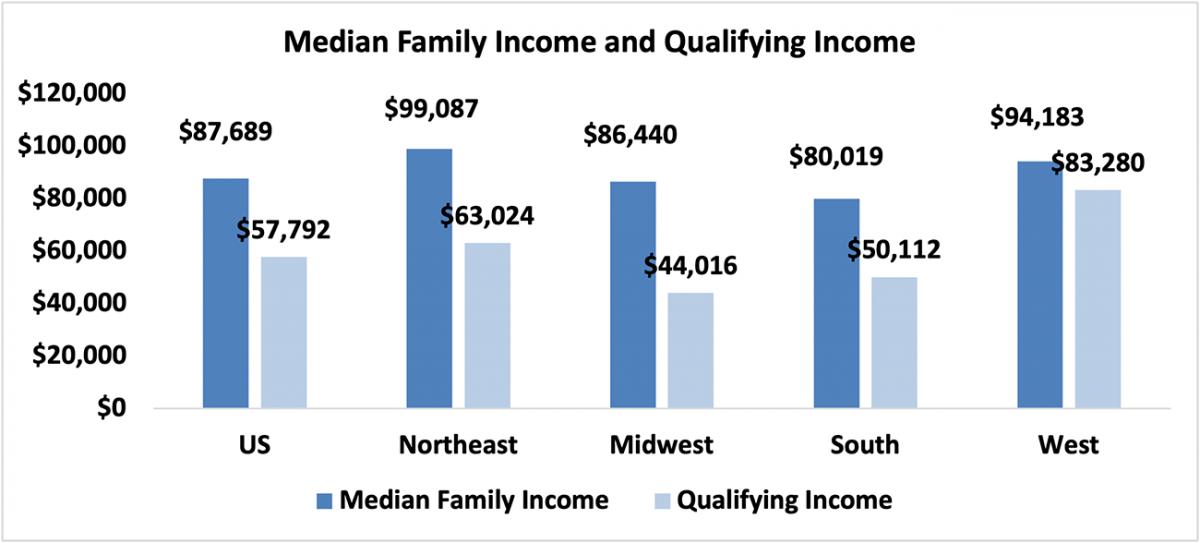

Homeowners in the West have the highest mortgage payments to income share at 22.1% of income. Home prices in the West have climbed to a record high of $513,700.

The most affordable region of the U.S. in housing continues to be the Midwest, in which the median family income is $86,440. NAR’s index calculates a qualifying income as the income required to afford a mortgage so that payments are no more than 25% of a family’s income. The Midwest had a qualifying income of $44,016.

View a further breakdown of the data in NAR’s Housing Affordability Index.Source: “Housing Affordability Falls in May as Home Prices Rise Faster Than Income,” National Association of REALTORS® Economists’ Outlook blog (July 9, 2021)

Mortgage Rates Remain Under 3%

Mortgage rates continued to inch lower this week as home buyers get another chance at securing ultra-low borrowing rates. Freddie Mac reports the average 30-year fixed-rate mortgage averaged 2.90%.

Home buyers can continue to benefit from low mortgage rates, particularly as home prices surge to a new record high of $350,300, Nadia Evangelou, senior economist at the National Association of REALTORS®, writes for the association’s Economists’ Outlook blog.

“Mortgage rates decreased this week following the dip in U.S. Treasury yields,” says Sam Khater, Freddie Mac’s chief economist. “While mortgage rates tend to follow Treasury yields closely, other factors can be impactful such as the labor markets, which are continuing to improve per last week’s jobs reports.”

Continue…https://magazine.realtor/daily-news/2021/07/09/mortgage-rates-remain-under-3

Retailers Look to Nearby Grocers to Draw Traffic

Grocery stores were deemed an essential business and remained open during the pandemic. They also posted record sales volume. Meanwhile, many malls and other retail stores closed for months and saw plummeting sales.

That’s why more retailers want grocery stores near them to attract more foot traffic. Grocery-anchored shopping centers are drawing heightened investor interest—and higher prices, The Wall Street Journal reports.

Continue…https://magazine.realtor/daily-news/2021/07/06/retailers-look-to-nearby-grocers-to-draw-traffic