Despite Fed Move, Mortgage Rates Hold Steady

Mortgage rates were in a holding pattern this week, even after the Federal Reserve voted Wednesday to hike its benchmark interest rate.

“As widely expected, the Fed increased the federal funds target rate this week for the third time in 2017,” says Len Kiefer, Freddie Mac’s deputy chief economist. “The market had already priced in the rate hike, so long-term interest rates—including mortgage rates—hardly moved. Mortgage rates held relatively flat across the board, with the 30-year fixed mortgage rate inching down 1 basis point to 3.93 percent in this week’s survey. Mortgage rates have been in a holding pattern for the fourth quarter, remaining within a 10 basis point range since October.”

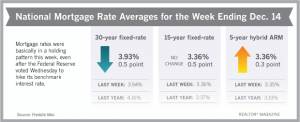

Freddie Mac reports the following national averages with mortgage rates for the week ending Dec. 14:

30-year fixed-rate mortgages: averaged 3.93 percent, with an average 0.5 point, dropping from last week’s 3.94 percent average. Last year at this time, 30-year rates averaged 4.16 percent.

15-year fixed-rate mortgages: averaged 3.36 percent, with an average 0.5 point, the same as last week. A year ago, 15-year rates averaged 3.37 percent.

5-year hybrid adjustable rate mortgages: averaged 3.36 percent, with an average 0.3 point, rising from last week’s 3.35 percent average. A year ago, 5-year ARMs averaged 3.19 percent.

Source: Freddie Mac

Daily Real Estate News | Friday, December 15, 2017